As the year draws to a close, now is a good time to review your credit reports. You want to make sure there are no errors, and no one is using your credit unlawfully. There are three main credit reporting agencies in the United States and you can easily request one FREE report from each of them once a year all in one place by visiting AnnualCreditReport.com. The reports are only visible once while you are logged into the browser. If you would like to refer back to it later, you’ll want to print the report or save it as a PDF.

Understanding your credit reports

Your credit report contains a LOT of information and may include:

-

Previous legal addresses and phone numbers

-

Places of employment

-

Up to nine years of financial data including:

-

For credit cards or lines of credit (including store cards): date account opened, highest balance owed, monthly balance owed/paid, timely payment information, date and reason closed (if applicable)

-

For loans including mortgages and student loans: date loan opened, initial balance owed, monthly payment, timely payment information, date and reason closed/paid off

-

Utility payments if late

-

Medical payment plans

-

Information on any account that has gone to collection

Your free credit report will NOT include your credit score although some of the credit bureaus will allow you to request that information.

Review each credit report carefully, examining every piece of data to look for accuracy. See sample report and notes below.

Resolving errors in your report

If you find an error or have any questions on one or more of your credit reports, contact the reporting agency directly.

Protecting your information in case of a data leak

If you believe you have been the victim of identity theft or have had your personal sensitive data stolen or leaked, you may want to purchase a credit monitoring/identity theft protection service. These packages provide routine monitoring of your credit reports and alert you in the event your report is being accessed or if there is an attempt to open a new account in your name. If you were notified by an organization that your personal information was involved in a leak, you may be able to sign up for credit monitoring services at no charge.

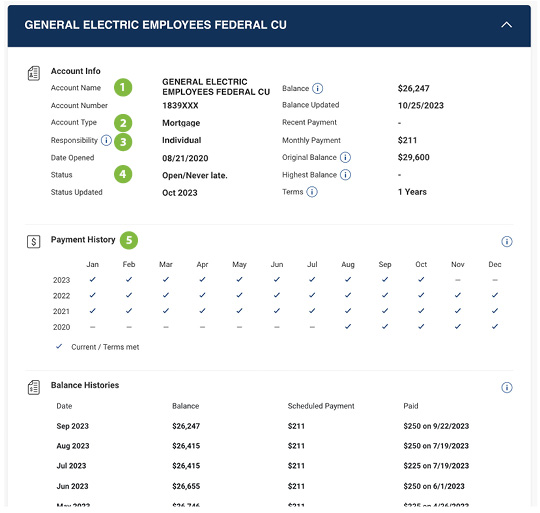

Sample Credit Report

This sample shows one account from a recent credit report. Notes appear below.

Notes:

1 The account name will be the legal name of the entity you have an account with. The names are often abbreviated and may be confusing.

2 Account type may also be listed as Revolving, Charge Card, etc.

3 Responsibility may be Individual or Joint. A joint owner’s name will be shown.

4 Status will indicate if the account is more than 30 days late or in default.

5 Payment history shows on-time payments with a checkmark. Late payments may be indicated with a number, e.g. “30” for a 30-day late payment.